This post is about the 19 best cheap crypto to buy now in 2025.

What if you could buy Bitcoin at $100 again? While that ship has sailed, hidden gems in the crypto market today could be 10x in the next bull run.

The key is finding undervalued cryptos with real potential before the crowd catches on.

This guide cuts through the noise to reveal the top cheap cryptos based on market trends, expert analysis, and real-world use cases.

There is no fluff — just the 19 best cheap crypto to buy right now.

Let’s dive in.

What Makes a Crypto “Cheap” and Worth Buying?

Not all cheap cryptos are good investments. Some are undervalued gems. Others are cheap for a reason—weak projects with no future.

So, how do you tell the difference?

First, what does “cheap” really mean? It’s not just about the price per coin. A token can cost pennies but still be overvalued.

What matters is the market cap—the total value of all coins in circulation. A low market cap means more room for growth.

Here’s what to look for in a cheap crypto worth buying:

- Low Market Cap, Strong Fundamentals – Undervalued coins with solid technology and real use cases can explode in value.

- Real-World Utility – Does the project solve a real problem? Coins with growing adoption often deliver the best returns.

- Strong Development Team and Roadmap – A skilled, active team with a clear vision is a great sign. Frequent updates mean the project is moving forward.

- Positive Sentiment and Growing Community – If more people believe in the project and back it, demand will increase, which is a recipe for price growth.

The best cheap cryptos check all these boxes. Now, let’s dive into the top picks for 2025.

19 Best Cheap Crypto to Buy Now (2025): Top Picks with Massive Potential

Finding undervalued cryptos before they take off is the key to maximizing profits.

Below are 9 promising projects with strong fundamentals, real-world utility, and serious growth potential.

1. CryptoTradeMate (CTM8) ($0.0005) – The Hidden AI Crypto Gem

CryptoTradeMate is an AI-powered trading bot that helps crypto traders make smarter moves. It scans the market, finds opportunities, and automates trades to maximize profits.

Even if you’re a beginner or an experienced trader, it takes the guesswork out of buying and selling.

The open-source AI-powered crypto trading bot uses advanced algorithms to analyze trends, detect patterns, and execute trades in real time.

Cryptotrademate works 24/7, so you never miss a good trade.

Plus, it supports multiple crypto strategies, from scalping to long-term investing.

With CryptoTradeMate, you get fast, accurate, and automated trading—no emotions, no stress. It’s like having an expert trader working for you around the clock.

Why It’s Cheap:

- Low market cap, early-stage project.

Why It’s a Buy:

- Strong team.

- Unique AI-driven trading technology.

- Recent partnerships.

Price Prediction:

- Potential for massive upside as adoption grows.

Buy Here:

2. PancakeSwap (CAKE) – The DeFi Underdog

PancakeSwap is the biggest decentralized exchange (DEX) on the Binance Smart Chain.

It allows users to swap tokens, provide liquidity, and earn passive income through farming and staking.

Unlike Uniswap, which runs on Ethereum and suffers from high gas fees, PancakeSwap offers faster and cheaper transactions.

UniSwap has a strong community and regular updates to improve the platform.

Why It’s Cheap:

- Smaller market cap compared to Uniswap.

- Less mainstream attention.

- Still expanding its ecosystem.

Why It’s a Buy:

- Huge user base on Binance Smart Chain.

- Strong partnerships and continuous upgrades.

- Earns revenue through trading fees, staking, and lotteries.

Potential Growth:

- As DeFi adoption grows, CAKE could see a major price jump.

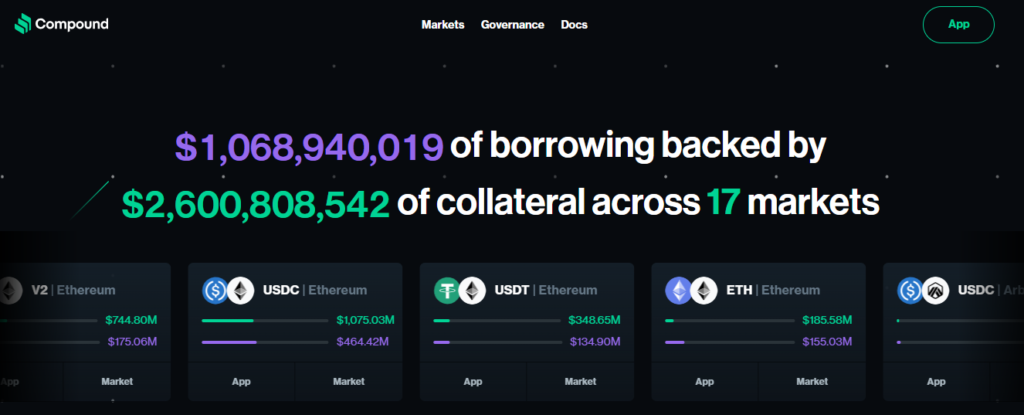

3. Compound (COMP) – The Crypto Lending Leader

Compound is one of the biggest DeFi lending platforms, allowing users to earn interest on their crypto or borrow against their holdings.

It’s like a decentralized bank but without middlemen.

Unlike traditional finance, Compound runs on smart contracts, meaning loans and interest rates adjust automatically based on supply and demand.

Why It’s Cheap:

- Still undervalued compared to Aave and Maker.

- DeFi lending is still an emerging sector.

- Fewer mainstream investors are aware of its potential.

Why It’s a Buy:

- Growing adoption for crypto borrowing and lending.

- Strong developer team continuously improving the platform.

- DeFi lending demand is expected to rise.

Potential Growth:

- As more people use DeFi loans, COMP’s price could surge.

4. Curve DAO (CRV) – The Stablecoin Exchange Giant

Curve is a key player in DeFi, specializing in stablecoin swaps. It helps traders and investors move between stablecoins like USDT, USDC, and DAI with minimal slippage.

Because stablecoins are a big part of crypto, Curve plays a crucial role in the ecosystem, making liquidity easier and more efficient.

Why It’s Cheap:

- Low hype compared to its actual utility.

- Market cap doesn’t reflect its importance in DeFi.

- Still expanding its integrations.

Why It’s a Buy:

- Powers liquidity for many DeFi protocols.

- Used by institutional investors and whales.

- Backed by strong DeFi projects and teams.

Potential Growth:

- As stablecoin adoption increases, CRV could see a big price jump.

5. Nexo (NEXO) – The Crypto Banking Alternative

Nexo is a platform that lets you earn interest on your crypto and take instant loans without selling your assets. It works like a crypto-friendly bank but without hidden fees or credit checks.

Unlike traditional banks, which pay low interest, Nexo offers high-yield savings for crypto holders.

Why It’s Cheap:

- Still growing its user base.

- Less well-known than competitors like Celsius.

- The market cap doesn’t reflect its potential.

Why It’s a Buy:

- Provides a real-world use case for crypto lending.

- Expanding partnerships with financial institutions.

- Pays user’s interest in crypto, making it attractive for investors.

Potential Growth:

- As more people use crypto banking, NEXO’s value could rise.

6. zkSync (ZKS) – The Future of Ethereum Scaling

zkSync is a Layer 2 solution for Ethereum, designed to make transactions faster and cheaper.

The blockchain platform uses zero-knowledge rollups to bundle transactions, reducing congestion on the main Ethereum network.

Ethereum struggles with high gas fees, but zkSync offers a way to fix that without sacrificing security.

Why It’s Cheap:

- Still under the radar compared to Arbitrum and Optimism.

- Many investors don’t fully understand Layer 2 solutions yet.

- The market cap is still low.

Why It’s a Buy:

- Solves Ethereum’s biggest problem: high fees.

- Growing adoption among developers and projects.

- Strong backing from major crypto investors.

Potential Growth:

- As Ethereum adoption increases, zkSync’s value could skyrocket.

7. 1inch (1INCH) – The Best DEX Aggregator

1inch is a platform that scans multiple decentralized exchanges to find the best price for your trade.

Instead of going to Uniswap, SushiSwap, or PancakeSwap separately, 1inch finds the best deal for you automatically.

Why It’s Cheap:

- Less marketing compared to other DeFi projects.

- Many traders don’t know they can save money using it.

- Still gaining mainstream adoption.

Why It’s a Buy:

- Saves users money by reducing slippage and fees.

- Integrates with multiple DEXs for better pricing.

- Strong use case in the growing DeFi sector.

Potential Growth:

- As DeFi trading increases, 1inch could gain significant value.

8. Synthetix Network Token (SNX) – The DeFi Game Changer

Synthetix is transforming DeFi by allowing users to trade synthetic assets that track real-world prices.

From stocks to commodities, SNX lets traders gain exposure without owning the actual asset.

This gives it a unique edge over traditional crypto projects.

More traders are turning to Synthetix as they look for decentralized ways to trade global markets.

Why It’s Cheap:

- Low hype despite strong fundamentals.

Why It’s a Buy:

- Solves real DeFi problems, has big investors, and offers a unique use case.

Potential Growth:

- High adoption could push prices significantly higher.

9. Basic Attention Token (BAT) – Powering the Future of Digital Ads

BAT is the backbone of Brave Browser, a privacy-focused alternative to Chrome. It rewards users for viewing ads while helping advertisers target the right audience.

With data privacy becoming a huge concern, more users are switching to Brave. This growing user base means higher demand for BAT.

Why It’s Cheap:

- Still flying under the radar despite real-world use.

Why It’s a Buy:

- A working product, increasing adoption, and a strong team.

Potential Growth:

- More Brave users mean higher BAT demand.

10. Celo (CELO) – Crypto for the Real World

Celo is bringing crypto to everyday users.

It’s designed for mobile payments, making it easier for people without bank accounts to send and receive money. Its focus on financial inclusion sets it apart from other blockchains.

With partnerships in emerging markets, Celo could see explosive adoption.

Why It’s Cheap:

- Undervalued compared to similar payment-focused projects.

Why It’s a Buy:

- A strong mission, real-world use, and growing partnerships.

Potential Growth:

- More users could lead to major price increases.

11. Ankr (ANKR) – The Cloud for Web3

Ankr provides decentralized cloud computing for blockchain applications.

Instead of relying on big tech companies, Web3 developers can use Ankr’s network to host their apps.

As blockchain adoption grows, demand for decentralized cloud services will explode. Ankr is positioned to lead this space.

Why It’s Cheap:

- Low awareness despite solving a huge problem.

Why It’s a Buy:

- Essential infrastructure for Web3.

- Strong developer adoption.

- Increasing partnerships.

Potential Growth:

- More projects using Ankr could drive prices up.

More Best Cheap Crypto to Buy Now (2025)

The crypto market moves fast, and the best opportunities are often the ones most people overlook.

Below are more promising low-cost cryptos with huge potential.

Each one has strong fundamentals, real-world utility, and a chance for massive growth.

12. Solana (SOL) – The Undervalued Powerhouse

Solana is a high-speed blockchain built for fast transactions and low fees. It can handle thousands of transactions per second, making it one of the fastest networks in crypto.

That’s why developers love building DeFi apps, NFTs, and Web3 projects on it.

Unlike Ethereum, which struggles with high fees, Solana keeps costs low. This makes it perfect for traders, gamers, and businesses looking for a smooth blockchain experience.

The Solana growing ecosystem includes decentralized exchanges, NFT marketplaces, and AI-driven apps.

With speed, low fees, and strong adoption, Solana is a powerhouse in the crypto space.

Why It’s Cheap:

- Still undervalued compared to competitors like Ethereum.

Why It’s a Buy:

- Lightning-fast transactions, a growing DeFi ecosystem, and a strong developer community.

Potential Growth:

- Increasing adoption could push prices significantly higher.

13. Fetch.ai (FET) – The Future of AI in DeFi

Fetch.ai combines blockchain and artificial intelligence to make crypto smarter. It creates autonomous AI agents that handle trading, data analysis, and DeFi automation without human input.

This means businesses and users can save time and maximize efficiency.

Its biggest use case is in decentralized finance (DeFi). Fetch.ai helps users optimize trades, predict market trends, and automate complex transactions.

It also improves supply chain management, smart cities, and IoT (Internet of Things) systems.

As AI adoption grows, Fetch.ai has massive potential. It’s a game-changer for DeFi, crypto trading, and beyond.

Why It’s Cheap:

- Low hype, but strong fundamentals.

Why It’s a Buy:

- AI-powered automation for DeFi, backed by major investors.

Price Prediction:

- With AI adoption rising, this could be a game-changer.

14. Maker (MKR) – The DeFi Powerhouse

Maker is a key player in decentralized finance (DeFi). It powers Dai (DAI), a stablecoin that stays pegged to the U.S. dollar without needing a bank.

This makes Dai a reliable alternative to traditional currencies, perfect for payments, savings, and DeFi trading.

The Maker protocol lets users lock up crypto as collateral to mint Dai. This removes the need for middlemen and keeps everything transparent.

MKR holders help govern the system, making key decisions about stability and upgrades.

As DeFi keeps growing, Maker is set to stay at the center of it all. It’s a solid project with real-world use and long-term potential.

Why It’s Cheap:

- Undervalued despite being a key player in DeFi.

Why It’s a Buy:

- A strong team, real-world use cases, and major partnerships.

Potential Growth:

- Increased DeFi adoption could drive a significant price surge.

15. Sui (SUI) – The Rising Star in Smart Contracts

Sui is a high-performance blockchain built to handle fast transactions with low fees.

It uses parallel processing, which means it can process multiple transactions at the same time instead of one by one like older blockchains.

This makes it perfect for DeFi, gaming, and NFTs.

Built by ex-Meta engineers, Sui is designed for developers who want to build powerful decentralized apps (dApps) without running into network congestion.

SUI’s unique object-based model gives users more control over their assets while keeping transactions lightning-fast.

As adoption grows, Sui could become one of the most efficient and user-friendly blockchains in the space.

Why It’s Cheap:

- Still flying under the radar compared to Ethereum and Solana.

Why It’s a Buy:

- Fast transactions, scalable blockchain, and growing adoption.

Potential Growth:

- Could see explosive gains as more developers build on it.

16. Polygon (MATIC) – Scaling Ethereum for Mass Adoption

Polygon is a scaling solution that makes Ethereum faster and cheaper to use.

Instead of replacing Ethereum, it works alongside it, helping users avoid high gas fees and slow transactions.

Polygon is perfect for DeFi, NFTs, and gaming because it keeps costs low while maintaining security.

Big projects like Uniswap, Aave, and OpenSea use Polygon to give users a smoother experience.

With more developers building on it, Polygon is becoming the go-to network for anyone who wants Ethereum’s security without the high costs.

Why It’s Cheap:

- Recent market corrections have pushed the price down.

Why It’s a Buy:

- Solves Ethereum’s scalability issues, backed by major investors.

Potential Growth:

- A key player in DeFi, gaming, and NFTs with long-term upside.

17. Near Protocol (NEAR) – The Fast and Scalable Blockchain

NEAR Protocol is a fast, low-cost, and developer-friendly blockchain built for the future of Web3.

The blockchain platform makes launching apps easy while keeping transactions cheap and lightning-fast.

With sharding technology, it can handle more traffic without slowing down or increasing fees.

That’s why projects in DeFi, NFTs, and gaming are choosing NEAR.

Big brands and developers love it because it’s easy to use, scalable, and super secure.

As Web3 grows, NEAR is set to play a huge role in making blockchain tech more accessible.

Why It’s Cheap:

- Low market cap compared to competitors like Solana.

Why It’s a Buy:

- High-speed transactions, a strong team, and growing partnerships.

Potential Growth:

- Could 10x as adoption increases.

18. Bittensor (TAO) – AI Meets Blockchain

Bittensor is changing how AI works by making it open, decentralized, and rewarding for contributors.

Instead of big companies controlling AI, it lets anyone train models, share knowledge, and earn rewards for their work.

It runs on a blockchain, so everything stays transparent and fair.

Developers and researchers can build, improve, and use AI models without limits.

As AI keeps growing, Bittensor could be a game-changer by making advanced technology more accessible and community-driven.

Why It’s Cheap:

Undervalued in the AI and crypto space.

Why It’s a Buy:

- Decentralized AI network with massive real-world potential.

Potential Growth:

- AI adoption is booming, and this project is at the forefront.

19. Avalanche (AVAX) – The High-Performance Blockchain

Avalanche is a high-speed, low-cost blockchain designed to handle thousands of transactions per second without slowing down.

It’s built for DeFi, NFTs, and enterprise solutions, making it a top choice for developers who need fast and efficient blockchain tech.

Unlike older blockchains, Avalanche uses a unique system that keeps it scalable and secure.

Projects launching on Avalanche get instant finality, meaning transactions are confirmed almost instantly.

As crypto adoption grows, Avalanche is set to play a huge role in the future of decentralized applications.

Why It’s Cheap:

- The market dip has kept its price lower than its true value.

Why It’s a Buy:

- Lightning-fast transactions, strong DeFi presence, and top-tier investors.

Potential Growth:

- Could rival Ethereum as a go-to smart contract platform.

These cryptos are not just cheap—they have the potential to deliver life-changing returns. Want even more insights?

Keep an eye on the market, do your research, and stay ahead of the next big wave.

These projects combine innovation, utility, and growth potential.

How to Research and Pick the Best Cheap Cryptos Yourself

Finding the next big crypto before it explodes isn’t about luck – it’s about smart research.

Instead of following the hype, use these simple steps to spot hidden gems with real potential.

1. Check the Market Cap

A low price doesn’t always mean a crypto is “cheap.” Market cap matters more.

A project with a low market cap has way more room to grow than one that’s already worth billions.

Look for solid projects under $1 billion that have the potential to be 10x or more.

2. Study the Use Case

A great project solves real problems. Ask yourself: What does this crypto do? Is it making payments easier?

Improving DeFi? Powering AI?

If it has real-world value and strong demand, it has a better shot at success.

3. Look at the Development Activity

A strong crypto project keeps building, no matter the market. Check GitHub, project updates, and new features.

Big partnerships and frequent improvements show a team that’s serious about long-term success.

4. Assess the Hype vs. Reality

Some projects explode in price because of social media hype, but many crash when the excitement fades.

Look beyond influencers and check real adoption. Are businesses using it? Is the community growing?

Does the tech work? Real utility beats hype every time.

Doing your research (DYOR) is the best way to find undervalued cryptos before they take off.

Follow these steps, stay ahead of the market, and you might just find the next big winner.

Best Platforms to Buy Cheap Cryptos

Knowing where to buy cheap cryptos can make all the difference.

Some platforms list hidden gems early, while others offer deep liquidity and security.

Here are the best places to find undervalued coins before they take off.

1. Binance – The King of Exchanges

Binance is the largest and most trusted crypto exchange. It has a huge selection of altcoins, including many low-cap gems.

With high liquidity, low fees, and strong security, it’s the go-to platform for most traders.

2. KuCoin – Where Altcoins Get Discovered

KuCoin is known for listing early-stage projects before they go mainstream.

Many cryptos that later pump on Binance or Coinbase start here. If you want to catch coins before the crowd, KuCoin is a solid choice.

3. Uniswap, PancakeSwap & Raydium – DeFi’s Hidden Treasure

Want to grab a token before it hits major exchanges? DeFi platforms like Uniswap (Ethereum-based) and PancakeSwap (BSC-based) let you buy low-cap cryptos directly from liquidity pools.

Raydium is another great place for catching early-stage gems. These platforms are riskier, but they also offer the highest upside.

Each of these platforms has its strengths. If you want safety and deep liquidity, go with Binance.

If you’re hunting for early-stage altcoins, KuCoin is a great bet.

And if you’re after high-risk, high-reward DeFi gems, Uniswap, PancakeSwap, and Raydium are the way to go.

Final Thoughts: Is It Too Late to Buy Cheap Crypto?

Nope, it’s not too late. The crypto market is always evolving, and new opportunities keep popping up.

Even in 2025, there are coins with 10x, 50x, and even 100x potential. The key is knowing where to look.

The best time to invest was years ago. The second-best time? Right now. But don’t just buy blindly.

Always do your research (DYOR) before jumping in.

Check the fundamentals, look at the team, and make sure the project has real-world value.

FAQs About the Best Cheap Crypto to Buy Now

Still have questions? Here are some quick answers to the most common ones about finding the best cheap cryptos to buy right now.

What is the best cheap crypto to buy right now?

There’s no single “best” choice, but some strong contenders include CryptoTradeMate (CTM8), Compound (COMP), Nexo (NEXO), and Celo (CELO). These projects have solid fundamentals, strong teams, and real-world use cases.

Which crypto will boom next?

No one can predict the future, but cryptos with low market caps, high adoption potential, and strong development teams have the best shot.

Watch for coins in AI, DeFi, and Layer 1 blockchain projects, as these sectors are growing fast.

Which coin will reach $1 in 2025?

Low-priced cryptos like CTM8, 1inch, and SNX have a chance, but it depends on demand, adoption, and overall market trends.

Always check the market cap, not just the price per coin.

Which crypto should I buy at a low price?

Look for coins with low market caps, strong fundamentals, and growing adoption. Some solid picks include Near (NEAR), CryptoTradeMate (CTM8), Maker (MKR), and AVAX.

These projects have big potential but are still trading at relatively low prices compared to their future potential.

Are cheap cryptos risky?

Yes, smaller cryptos can be more volatile than Bitcoin or Ethereum.

Always research the team, use case, and community before buying.

Never invest more than you can afford to lose.

Where can I buy cheap cryptos?

The best platforms include Binance, KuCoin, Uniswap, PancakeSwap, and Raydium. If you want safer bets, stick to Binance and KuCoin.

If you’re looking for early-stage gems, check out DeFi exchanges.

How do I know if a cheap crypto is a good investment?

Check its market cap, real-world use case, development activity, and community support.

Avoid projects with no real purpose, inactive teams, or too much hype without results.

Finding the next big crypto early takes research and patience. Stick to strong projects, watch the market, and you can catch the next 10x gem.